SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þý

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

| | |

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

þ x Definitive Proxy Statement

|

o Definitive Additional Materials

|

o Soliciting Material Pursuant to §240.14a-12

|

NUMEREX CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | |

þý | No fee required. |

| | |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

o | Fee paid previously with preliminary materials. |

| | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

NUMEREX CORP.

1600 Parkwood Circle SE, Suite 500

Atlanta, Georgia 30339

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

MAY 21, 201020, 2011

11:00 a.m. Eastern Time

Dear Shareholders:

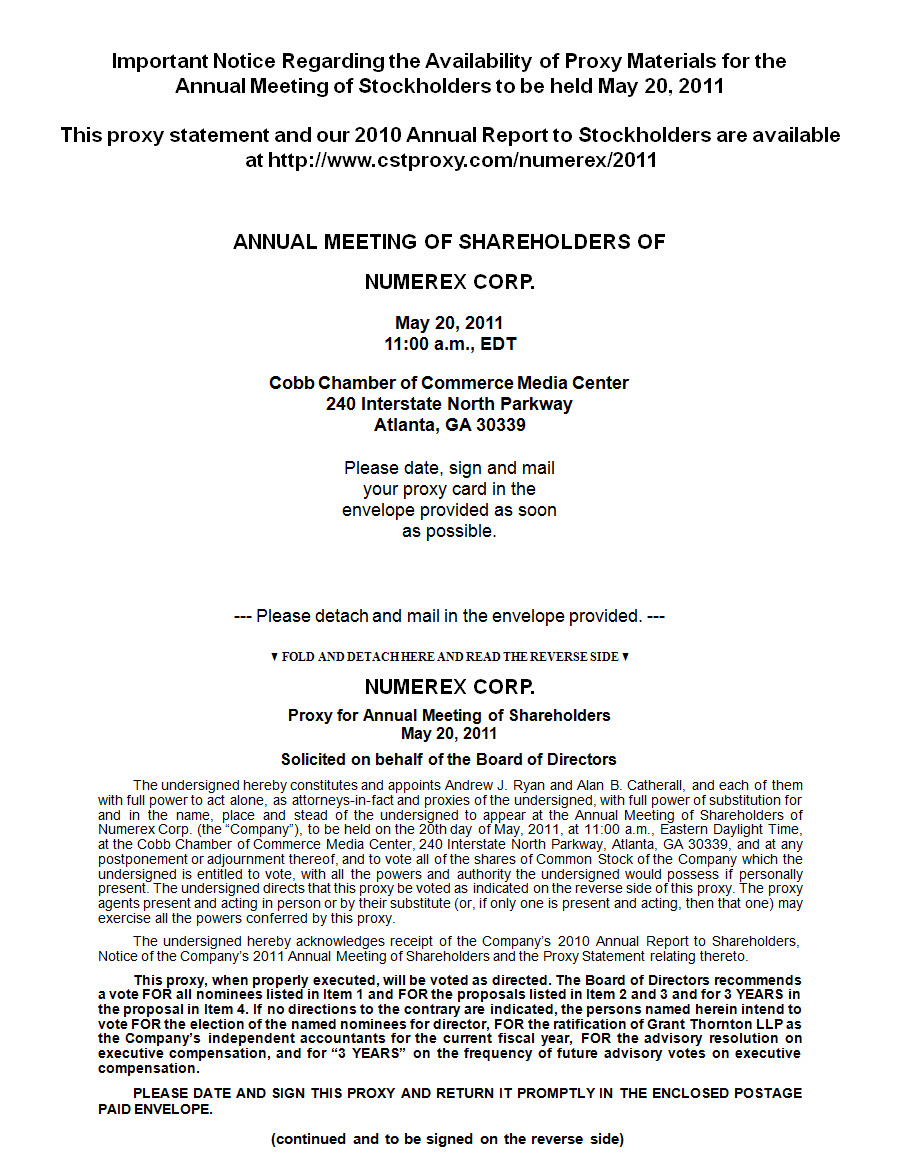

Notice is hereby given that the 20102011 annual meeting of shareholders (the “Annual Meeting”) of Numerex Corp., a Pennsylvania corporation (the “Company”), will be held on Friday, May 21, 201020, 2011 at 11:00 a.m. Eastern Time in the Media Center at the Cobb Chamber of Commerce, 240 Interstate North Parkway, Atlanta, Georgia 30339 for the following purposes:

| | 1. | | To elect six nominees to serve as directors of the Company; |

| 2. | | 2. | To ratify the appointment of Grant Thornton LLP as the independent accountants of the Company; |

| 3. | To approve an advisory vote on executive compensation; |

| 4. | 3. | To conduct an advisory vote to approve the proposed amendments to the Company’s 2006 Long-Term Incentive Plan, to increase the numberfrequency of shares available for issuance and to permit the issuance of stock appreciation rights;vote on executive compensation; and |

| 5. | 4.. | To transact such other business as may properly come before the Annual Meeting and any postponement(s) or adjournment(s) thereof. |

Only shareholders of record as of the close of business on March 25, 20102011 are entitled to receive notice of, to attend, and to vote at the Annual Meeting.

Under rules adopted by the Securities and Exchange Commission (the “SEC”), the Company is pleased to make this Proxy Statement and the Company’s Annual Report to Shareholders available on the internet instead of mailing a printed copy of these materials to each shareholder. Accordingly, you can access proxy materials and vote at www.proxyvote.com. Shareholders who receive a Notice of Internet Availability of Proxy Materials (the “Notice”) by mail will not receive a printed copy of these materials other than as described below. Instead, the Notice contains instructions as to how shareholders may access and review all of the important information contained in the materials on the Internet, including how shareholders may submit proxies by telephone or over the Internet.

If you received the Notice by mail and would prefer to receive a printed copy of the Company’s proxy materials, please follow the instructions for requesting printed copies included in the Notice. The Company believes these rules allow it to provide you with the information you need while lowering delivery costs and reducing the environmental impact of the Annual Meeting. This Proxy Statement will be made available to stockholders on or abo utabout April 6, 2010.8, 2011.

You are cordially invited to attend the Annual Meeting in person. However, to ensure your vote is counted at the Annual Meeting, please vote as promptly as possible as provided in the Notice.

| | Sincerely, |

| | |

| | /s/ Stratton J. Nicolaides |

| | Stratton J. Nicolaides |

| | Chairman and Chief Executive Officer |

| | |

| | |

| | /s/ Andrew J. Ryan |

| | Andrew J. Ryan |

| | General Counsel and Secretary |

| | |

| Atlanta, Georgia | |

April 6, 20108, 2011 | |

NUMEREX CORP.

1600 Parkwood Circle SE, Suite 500

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

GENERAL INFORMATION

Why am I receiving these materials and why did I receive a one-page Notice of Internet Availability of Proxy Materials in the mail regarding the Internet availability of proxy materials this year instead of a full set of proxy materials?

These materials are being made available in connection with the Company's solicitation of proxies for use at the Annual Meeting, to be held on Friday, May 21, 201020, 2011 at 11:00 a.m. Eastern Time, and any postponement(s) or adjournment(s) thereof. Under SEC rules, , the Company is making this Proxy Statement and the Company’s Annual Report to Shareholders available on the Internet instead of mailing a printed copy of these materials to each shareholder. Shareholders who received the Notice of Internet Availability of Proxy Materials (the “Notice”) by mail will not receive a printed copy of these materials other than as described in the Notice, which contains instructions as to how shareholders may access and review all of the important information contained in the materials on the Internet, including how sharehol dersshareholders may submit proxies by telephone or over the Internet.

What is included in the proxy materials?

These proxy materials include:

· | the Proxy Statement for the Annual Meeting; and |

| · | the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2009,2010, as filed with the SEC on March 29, 201030, 2011 (the “Annual Report”). |

If you requested printed versions of these materials by mail as provided in the Notice, these materials also include the printed proxy card for the Annual Meeting.

What matters will be voted on at the Annual Meeting?

Shareholders will vote on threefour items at the Annual Meeting:

| · | the election to the Board of the six nominees named in this Proxy Statement (Proposal No. 1); |

| · | ratification of the appointment of Grant Thornton LLP as the independent accountants of the Company (Proposal No. 2); |

| · | select advisory resolution on executive compensation (Proposal 3); and |

| · | approvalselect frequency of the proposed amendment to the Company’s 2006 Long-Term Incentive Plan to increase the number of shares available for issuance and to permit the issuance of stock appreciation rightsfuture advisory votes on executive compensation (Proposal No. 3).4) |

Who may vote at the Annual Meeting?

As of the close of business on March 25, 20102011 (the “Record Date”), there were 15,085,50115,042,028 shares of the Company's common stock issued and outstanding, held by 5655 shareholders of record. Only shareholders of record as of the Record Date are entitled to receive notice of the Annual Meeting and vote their shares as provided in the Notice. Each share of the Company's common stock has one vote on each matter.

What are the Board's voting recommendations?

The Board recommends that you vote your shares:

| · | “FOR” each of the nominees to the Board (Proposal No.1)1); |

| · | “FOR” ratification of the appointment of Grant Thornton LLP (Proposal No.2)2); and |

| · | “FOR” approval of the proposed amendment to the Company’s 2006 Long-Term Incentive Plan to increase the numberadvisory resolution of shares availableexecutive compensation (Proposal 3); and |

| · | “3 years" for issuanceexecutive compensation approval and to permit the issuancefrequency of stock appreciation rightsexecutive compensation review (Proposal No. 3)4). |

What is the difference between a shareholder of record and a beneficial owner of shares held in street name?

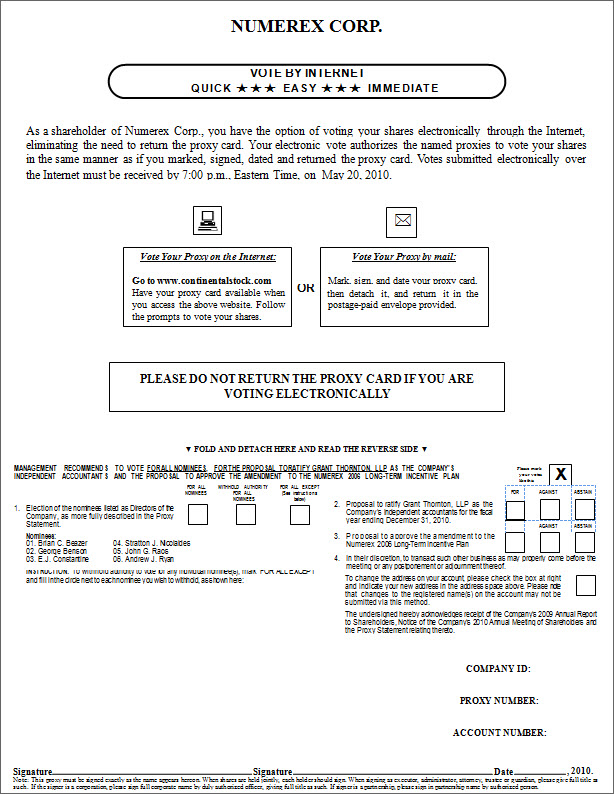

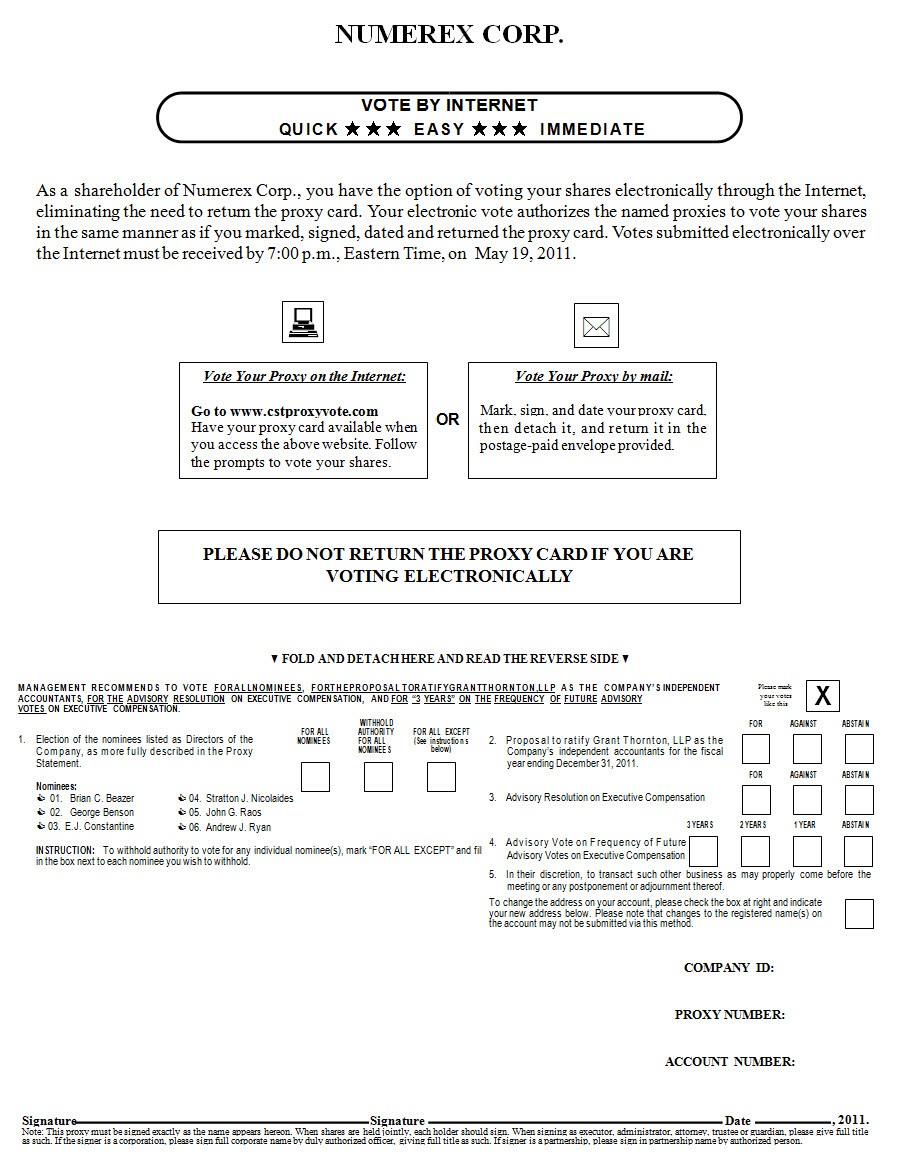

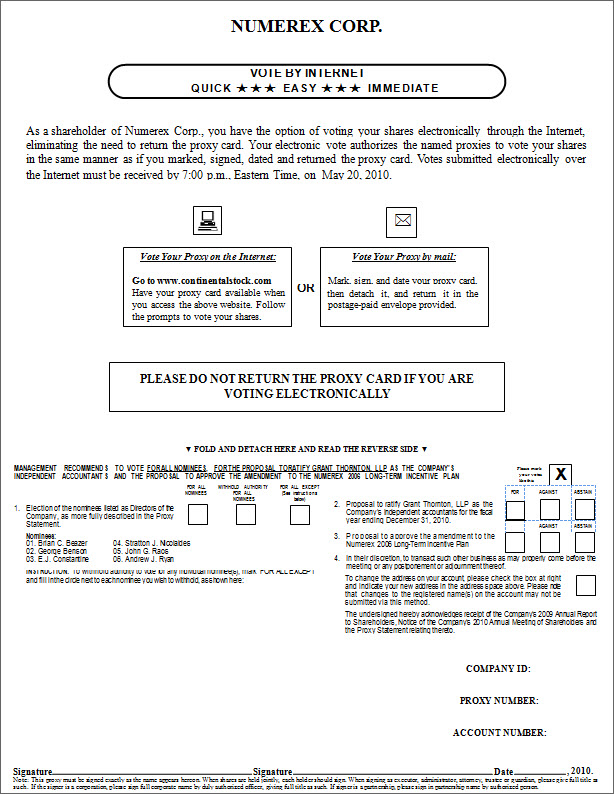

Shareholder of Record. If your shares are registered directly in your name with the Company's transfer agent, Continental Stock Transfer & Trust Company (“Continental”), you are considered the shareholder of record with respect to those shares, and the Notice was sent directly to you by the Company. If you request printed copies of the proxy materials by mail, you will receive a proxy card.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in “street name,” and the Notice was forwarded to you by that organization. 'TheThe organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares held in your account. lfIf you request printed copies of the proxy materials by mail, you will receive a vote instruction form.

If I am a shareholder of record of the Company's shares, how do I vote?

There are four ways to vote:

| · | In person. If you are a shareholder of record, you may vote in person at the Annual Meeting, The Company will give you a ballot when you arrive. |

| · | Via the Internet. You may votevot by proxy via the Internet by following the instructions provided in the Notice. |

| · | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the toll free number found on the proxy card. |

| · | By Mail. If you request printed copies of the proxy materialsmaerials by mail, you may vote by proxy by filling out the proxy card and sending it back in the envelope provided. |

If I am a beneficial owner of shares held in street name, how do I vote?

There are four ways to vote:

| · | In person. If you are a beneficial owner of shares held in street name and you wish to vote in person at the Annual Meeting, you must obtain a legal proxy from the organization that holds your shares.shares |

| · | Via the Internet.Internet. You may vote by proxy via the Internet by visiting the website designated in the Notice and entering the control number found in the Notice. |

| · | By Telephone. If you request printed copies of the proxy materials by mail, you may vote by proxy by calling the toll free number found on the vote instruction form. |

| · | By Mail. If you request printed copies of the proxy materialsmaerials by mail, you may vote by proxy by filling out the vote instruction form and sending it back in the envelope provided. |

What is the quorum requirement for the Annual Meeting?

The holders of a majority of the shares entitled to vote at the Annual Meeting must be present at Annual Meeting for the transaction of business. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum, whether representing votes for, against, or abstentions, if you:

| · | are present and vote in person at the Annual Meeting; or |

| · | have voted on the Internet, by telephone or by properly submitting a proxy card or vote instruction form by mail. |

If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained.

How are proxies voted?

All valid proxies received prior to the Annual Meeting will be voted. All shares represented by a proxy will be voted and, where a shareholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the shareholder's instructions.

What happens if I do not give specific voting instructions?

Shareholders of Record. If you are a shareholder of record and you:

| · | indicate when voting on the Internet or by telephone that you wish to vote as recommended by the Board, or |

| · | sign and return a proxy card without giving specific voting instructions, |

then the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting. See the section entitled “Other Matters” below.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of variousthe SEC and the national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters.

Who will serve as the inspector of election?

Alan Catherall, Chief Financial Officer of Numerex Corp., will serve as the inspector of election.

Who pays for this proxy solicitation?

This proxy is solicited by the Board, and the cost of solicitation will be paid by the Company. Additional solicitation may be made by mail, personal interview, telephone, or facsimile by Company personnel, who will not be additionally compensated for such effort. The cost of any such additional solicitation will be borne by the Company.

Which ballot measures are considered “routine” or “non-routine”?

Under Nasdaq rules governing brokers, your bank, broker or other nominee may vote your shares in its discretion on “routine” matters. These rules also provide, however, that when a proposal is not a “routine” matter and your bank, broker or other nominee has not received your voting instructions with respect to such proposal, your bank, broker or other nominee cannot vote your shares on that proposal. When a bank, broker or other nominee does not cast a vote for a routine or a non-routine matter, it is called a “broker non-vote.” Please note that this year, the rules that guide how brokers vote your stock have changed. Your bank, broker or other nominee may no longer vote your shares with respect to the election of the nominees for director in the ab sence of your specific instructions as to how to vote with respect to the election of such nominees, because under such rules the election of directors is not considered a “routine” matter. In addition, under theseUnder current rules, your bank, broker or other nominee cannot vote your shares with respect to the approval of the amendment to the Numerex 2006 Long-Term Incentive Plan without your voting instructions because this proposal is not considered “routine.” For your vote to be counted in the election of directors or with respect to the amendment to the Numerex 2006 Long-Term Incentive Plan, you now will need to communicate your voting decisions to your bank, broker or other holder of record before the date of the Annual Meeting. The ratification of the appointment of Grant Thornton LLP is considered a routine matter, so your bank or broker will not have discretionary authority to vote your shares held in street nameat the Annual Meeting on those items.any of the matters to be considered at the Annual Meeting other than the ratification of our independent public accountants. We encourage you to provide instructions to your bank, broker or nominee by carefully following the instructions provided. This will ensure that your shares are voted at the Annual Meeting as you direct.

How are broker non-votes treated?

Broker non-votes are counted for purposes of determining whether a quorum is present. Broker non-votes will not affect the outcome of voting for the election of directors (Proposal No. 1), the ratification of Grant Thornton LLP (Proposal 2), advisory vote on executive compensation (Proposal 3) or the amendmentadvisory vote to approve frequency of the 2006 Long-Term Incentive Planvote on executive compensation (Proposal 3)4). We encourage you to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the Notice.

How are abstentions treated?

Abstentions are counted for purposes of determining whether a quorum is present. Shares not present at the Annual Meeting and abstentions have no effect on the election of directors (Proposal No. l), the ratification of Grant Thornton LLP (Proposal No. 2), advisory vote on executive compensation (Proposal 3) or the amendmentadvisory vote to approve frequency of the 2006 Long-Term Incentive Planvote on executive compensation (Proposal 3)4).

What is the voting requirement to approve each of the proposals?

For Proposal No.1,1, the six nominees receiving the highest number of affirmative votes of the outstanding shares of the Company's common stock present or represented by proxy and voting at the Annual Meeting will be elected as directors to serve until the next annual meeting of shareholders and until their successors are duly elected and qualified. Approval of Proposals No. 2, 3 and 3 each require4 requires the affirmative vote of a majority of the voting power present or represented by proxy and voting at the Annual Meeting.

Can I change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the final vote at the Annual Meeting. You may vote again on a later date via the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the Annual Meeting will be counted), by signing and returning a new proxy card or vote instruction form with a later date, or by attending the Annual Meeting and voting in person. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you vote again at the Annual Meeting or specifically request that your prior proxy be revoked by delivering to the Company's Secretary at 1600 Parkwood Circle SE, Suite 500, Atlanta, Georgia 30339 a written notice of revocation prior to the Annual Meeting.

Proxy instructions, ballots, and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except:

| · | as necessary to meet applicable legal requirements; |

| · | to allow for the tabulation and certification of votes by Alan Catherall, the Company’s Chief Financial Officer, who is serving as the Inspector of Election; and |

| · | to facilitate a successful proxy solicitation. |

Occasionally, shareholders provide written comments on their proxy cards, which may be forwarded to the Company's management and the Board.

How can I attend the Annual Meeting?

Attendance at the Annual Meeting is limited to shareholders. Admission to the Annual Meeting will be on a first-come, first-served basis. Registration will begin at 11:00 a.m. Eastern Time, and each shareholder may be asked to present valid picture identification such as a driver's license or passport and proof of stock ownership as of the Record Date. The use of cell phones, PDAs, pagers, recording and photographic equipment and/or computers is not permitted in the meeting rooms at the Annual Meeting.

Where can I find the voting results of the Annual Meeting?

The preliminary voting results will be announced at the Annual Meeting. We will include the voting results in a Form 8-K, which will be filed with the Securities and Exchange Commission within four business days following the conclusion of the Annual Meeting.

What is the deadline to propose actions for consideration or to nominate individuals to serve as directors at the 20112012 annual meeting of shareholders?

Requirements for Shareholder Proposals to be Considered for Inclusion in the Company's Proxy Materials. Shareholder proposals to be considered for inclusion in the proxy statement and form of proxy relating to the 20112012 annual meeting of shareholders must be received no later than December 7, 2010.31, 2011. In addition, all proposals must comply with Rule 14a-8 of the Securities Exchange Act of 1934 (the “Exchange Act”), which lists the requirements for the inclusion of shareholder proposals in company-sponsored proxy materials. Shareholder proposals must be delivered to the Company’s General Counsel and Secretary by mail at 1600 Parkwood Circle SE, Suite 500, Atlanta, Georgia 30339 or by facsimile at (770) 693-5951.

Requirements for Shareholder Proposals to be Brought before the 20112012 Annual Meeting of Shareholders. Notice of any director nomination or other proposal that you intend to present at the 20112012 annual meeting of shareholders, but do not intend to have included in the proxy statement and form of proxy relating to the 20112012 annual meeting of shareholders, must be delivered to the Company's General Counsel and Secretary by mail at 1600 Parkwood Circle SE, Suite 500, Atlanta, Georgia 30339 or by facsimile at (770) 693-5951 not later than February 21, 2011 .10, 2012. In addition, your notice must set forth the information required by the Company's bylaws with respect to each director nomination or other proposal that you intend to present at the 20102012 annual meeting of shareholders. Ple asePlease read the bylaws carefully to ensure that you comply with all requirements.

Where are the Company'sCompany’s principal executive offices located and what are is the Company's main telephone number?

The Company's principal executive offices are located at 1600 Parkwood Circle SE, Suite 500, Atlanta, Georgia 30339 and the Company's main telephone number is (770) 693-5950.

What are the Company’s Fiscal Years?

As used in this Proxy Statement, “FY 2007”2008” means the Company’s fiscal year ended December 31, 2007. “FY 2008” means the Company’s fiscal year ending December 31, 2008. “FY 2009” means the Company’s fiscal year ending December 31, 2009. “FY 2010” means the Company’s fiscal year ending December 31, 2010.

“FY 2011” means the Company’s fiscal year ending December 31, 2011.

PROPOSAL ONE: ELECTION OF DIRECTORS

The Bylaws of the Company provide that the Board of Directors, or the “Board,” shall consist of not less than three nor more than ten directors and that the number of directors, subject to the foregoing limits, shall be determined from time to time by the Board of Directors. The Board of Directors has fixed the number of directors at a six. At the Annual Meeting six directors, who will constitute the Company’s entire Board of Directors, are to be elected to hold office until the next annual meeting and until their respective successors have been duly elected and qualified. The Board of Directors has designated the persons listed below to be nominees for election as directors, and each nominee has consented to being named in this Proxy Statement and to serve if elected..elected. The Company has no reason to believe that any of th ethe nominees will be unwilling or unable to serve; however, should any nominee become unavailable for any reason, the Board of Directors may designate a substitute nominee. The proxy holders intend (unless authority has been withheld) to vote for the election of the Company’s nominees.

The Board of Directors has determined that Brian C. Beazer, George Benson, E. James Constantine, and John G. Raos, constituting a majority of the Board members, are “independent directors” as that term is defined in the NASDAQ listing standards and that Stratton Nicolaides and Andrew Ryan are not “independent directors” under the NASDAQ listing standards. The Director nominees for election at the 20102011 Annual Meeting were recommended by the Nominating and Corporate Governance Committee and were approved by a majority of the independent members of the Board of Directors.

Listed below are the Company’s six director nominees, all of whom are nominated for re-election at the Annual Meeting. All of the directors elected at the Annual Meeting will serve a one-year term expiring at the next annual meeting of shareholders.

| Name | | Age* | | Position | | Director Since | | Age* | | Position | | Director Since | |

| Brian C. Beazer | | 75 | | Director | | 2002 | |

| Bri Brian C. Beazer | | | | 76 | | Director | | | 2002 | |

| George Benson | | 75 | | Director | | 1995 | | | 76 | | Director | | | 1995 | |

| E. James Constantine | | 62 | | Director | | 2008 | | | 63 | | Director | | | 2008 | |

| Stratton J. Nicolaides | | 56 | | Chairman of the Board and Chief Executive Officer | | 1999 | | | 57 | | Chairman of the Board and Chief Executive Officer | | | 1999 | |

| John G. Raos | | 61 | | Lead Director and Vice-Chairman of the Board | | 2000 | | | 62 | | Lead Director and Vice-Chairman of the Board | | | 2000 | |

| Andrew J. Ryan | | 51 | | Director | | 1996 | | | 52 | | Director | | | 1996 | |

*As of April 6, 2010.8, 2011.

Set forth below is a brief description of the principal occupation and business experience of each of our nominees for director, as well as the summary of our views as to the qualifications of each nominee and continuing director to serve on the Board and each board committee of which he is a member. Our views are informed not only by the current and prior employment and educational background of our directors, but also by the Board’s experience in working with their fellow directors. Each director has served on the Board for at least twothree years, and certain nominees and continuing directors have ten or more years of experience on our Board. Accordingly, the Board has had significant experience with the incumbent directors and has had the opportunity to assess the contributions that the directors have made to the board as well as their industry knowledge, judgment and leadership capabilities.

Brian C. Beazer has served as a director of the Company since June 2002. Mr. Beazer is currently the Non-Executive Chairman of the Board of Beazer Homes USA Inc., a national homebuilder headquartered in Atlanta, Georgia, and has served as a director of Beazer since its inception in November 1993. Mr. Beazer served as Chief Executive Officer of Beazer PLC or its predecessors from 1968 to 1991 and as Chairman of that company from 1983 until the date of its acquisition by an indirect, wholly owned subsidiary of Hanson PLC effective December 1, 1991. Mr. Beazer is also a director of Beazer Japan, Ltd., and Seal Mint, Ltd., and United Pacific Industries Limited. As a result of Mr. Beazer’s long tenure at Beazer Homes USA, a pub licpublic company, he provides valuable business, leadership and management insights into our strategic direction and business operations, among other things. Mr. Beazer’s brings expertise in residential real estate, an important market for our products and services. In addition, through his experience at Beazer Homes, Mr. Beazer brings financial expertise as well as executive compensation experience, qualifying him to serve on our Audit Committee and Compensation Committee, and his service on the board of directors of Beazer Homes provides the Nominating and Corporate Governance Committee with valuable insight on the selection of directors and corporate governance practices.

George Benson has served as a director of the Company since June 1995. Mr. Benson is currently Chairman and Chief Executive Officer of Wisconsin Wireless Communications Corp. and has served in such role since 1992. He also founded Airadigm Communications, Inc. in 1994 and served as its Chairman and Chief Executive Officer until his retirement as Chairman Emeritus in June of 1999. We believe that Mr. Benson’s deep expertise in wireless communication provides a strong operational and strategic background and adds valuable business, leadership and management experience and insights into many aspects of our business. Mr. Benson’s experience in developing appropriate compensation for the executives and senior management of his other com paniescompanies qualifies him to serve on our Compensation Committee, and his experience on our board, as well as his management experience with Wisconsin Wireless Communications Corp, provides him with a solid background for service on our Auditing Committee as well as our Nominating and Corporate Governance Committee.

E. James Constantine has served as a director of the Company since October 2008. Since 2006, Mr. Constantine has served as Chief Executive Officer of HPE America LLC, a holding of Piero Ferrari involved in power train development for NASCAR and Formula 1 racing vehicles. From February 2003 until July 2006, Mr. Constantine was the Chief Executive Officer of Delta Motors LLC and a private holding company, MY Ventures, LLC, which held entities engaged in development of embedded cellular transceivers, GPS and location-based services and technology, special purpose vehicles, and commercial real estate. He previously served on the Board of Governors of Claremont McKenna College’s Kravis Leadership Institute, and was the commercial consultant to the City of Los Angeles for the creation of its electric vehicle initiative and development of the first p arallelparallel hybrid vehicle. Mr. Constantine’s tenure as CEO of a company in the auto industry and a wireless communications company provide valuable business, leadership and management experience, including expertise in creating value and product development for our customers in the auto and real estate sectors. Mr. Constantine’s experience as a chief executive officer also provides valuable insights to our Nominating and Corporate Governance Committee.

Stratton J. Nicolaides has served as Chief Executive Officer of the Company since April 2000, and served as Chief Operating Officer from April 1999 until March 2000, and as Chairman of the Board of Directors since December 1999. In 2007, Mr. Nicolaides began serving as a director the Taylor Hooton Foundation, a non-profit organization formed to fight steroid abuse by America’s youth. With his years of experience in the wireless communication industry, including more than eleven years of senior management experience at Numerex, we believe that Mr. Nicolaides’s deep industry knowledge and his expertise in our operations, product development and corporate strategy provides the Board with significant insight across a broad range of issues critical to ou rour business. As our chief executive officer, Mr. Nicolaides provides unique insight to the Board regarding our day-to-day operations, customer information, competitive intelligence, general trends in our industry and issues regarding our financial results.

John G. Raos has served as a director of the Company since February 2000, now serves as Lead Director, and was named Vice-Chairman of the Board in March 2008. Since 2000,August 2010, Mr. Raos has been Chief Executive Officer of Strategic Investments, LLC, a privately owned investment management and holding company. Mr. Raos served as Chief Executive Officer of Precision Partners, Inc., a global, diversified manufacturing and engineering services company.company from July 2000 until June 2010. From June 1995 until January 2000, Mr. Raos served as President and Chief Operating Officer of US Industries, Inc. From February 1999 until January 2000, Mr. Raos also served as Chairman and Chief Executive Officer of Strategic Industries, Inc., a US Industries subsidiary. Prior to June 1995, Mr. Raos served as President, Chief Operating Officer, and Director of Hanson Industries, Inc., the North American arm of Hanson P LC.PLC. Mr. Raos also served as a director of Hanson PLC from 1990 until 1995. In addition, Mr. Raos held the positions of Chief Financial Officer and Treasurer of Hanson Industries, Inc., and is a member of the American Institute of Certified Public Accountant.Accountants (AICPA) and National Association of Corporate Directors (NADC).

We believe Mr. Raos’ more than 10 years of service as a director of Numerex and his career experience in the business markets which we serve provides the Board with valuable perspective on the issues facing the Company and insight into the markets we serve, and assists our Compensation Committee in developing our compensation policies and practices in order to secure talented employees, management and directors. We believe that Mr. Raos’s operating experience brings a valuable perspective to the Board both with respect to accounting and financial and strategic aspects of our business and to the Audit Committee on which he serves as “audit committee financial expert.”

Andrew J. Ryan has served as a director of the Company since May 1996. Mr. Ryan has practiced law with the law firm of Salisbury & Ryan since August 1994 and serves as the Board of Directors designee of Gwynedd Resources, Ltd. in accordance with Gwynedd’sits contractual right to designate a member of the Board of Directors. Mr. Ryan’s wide-ranging legal practice and breadth of experience gained with his more than 15 years of experience with the Company has been of particular value in assisting the Board with evaluating business and strategic issues. Mr. Ryan provides the Board with significant operational insights regarding operational strategies and corporate governance issues.

Required Vote

If a quorum is present, the nominees receiving the highest number of affirmative votes of the shares present or represented by proxy and entitled to vote on the matter at the Annual Meeting shall be elected as directors. An abstention, withholding of authority to vote, or broker non-vote will have no effect on the vote and will not be counted in determining whether any proposal has received the required shareholder vote.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF MSSRS. BEAZER, BENSON, CONSTANTINE, NICOLAIDES, RAOS AND RYAN FOR ELECTION TO THE BOARD OF DIRECTORS.

* * *

PROPOSAL TWO: RATIFICATION OF INDEPENDENT ACCOUNTANTS

The Board of Directors, upon the recommendation of the Audit Committee, has selected the firm of Grant Thornton LLP as independent accountants of the Company for the fiscal year ending December 31, 2010.2011. This nationally known firm has no direct or indirect financial interest in the Company.

Although not required to do so, the Board of Directors is submitting the appointment of Grant Thornton LLP as the Company’s independent accountants for FY 20102011 for ratification by the shareholders at the Annual Meeting as a matter of good corporate governance. If a majority of the votes cast in person or by proxy at the Annual Meeting is not voted for ratification, the Board of Directors will reconsider its appointment of Grant Thornton LLP as independent accountants for the current fiscal year. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of Numerex and its shareholders.

A representative of Grant Thornton LLP will be present at the Annual Meeting and will have the opportunity to make a statement if he or she desires to do so. It is anticipated that such representative will be available to respond to appropriate questions from shareholders.

Required Vote

Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 20102011 requires the affirmative “FOR” vote of a majority of the votes cast on the proposal. Unless marked to the contrary, proxies received will be voted “FOR” ratification of the appointment of Grant Thornton LLP. Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF GRANT THORNTON LLP AS INDEPENDENT ACCOUNTANTS FOR FY 2010.2011.

***

MATTERS CONCERNING THE COMPANY’S INDEPENDENT AUDITORS

The Audit Committee Charter contains procedures for the pre-approval of audit and non-audit services (the “Pre-Approval Policy”) to ensure that all audit and permitted non-audit services to be provided to the Company have been pre-approved by the Audit Committee. Specifically, the Audit Committee pre-approves the use of Grant Thornton LLP for specific audit and non-audit services, except that pre-approval of non-audit services is not required if the “de minimis” provisions of Section 10A(i)(1)(B) of the Exchange Act are satisfied. If a proposed service has not been pre-approved pursuant to the Pre-Approval Policy, then it must be specifically pre-approved by the Audit Committee before it may be provided by Grant Thornton. For additional information concerning the Audit Committee and its activities with Gran tGrant Thornton, see “Corporate Governance — Audit Committee” and “Report of the Audit Committee” in this proxy statement.

During FY 20092010 and FY 2008,2009, Grant Thornton LLP provided services to the Company in the following categories and amounts:

Audit and Other Fees | | FY 2009 ($) | | | FY 2008 ($) | | | FY 2010 ($) | | FY 2009 ($) | |

| | | | | | | | | | | | |

| Audit Fees | | $ | 467,041 | | | $ | 561,500 | | | $ | 432,626 | | $ | 467,041 | |

| Audit-Related Fees | | $ | 0 | | | $ | 0 | | | $ | 0 | | $ | 0 | |

| Tax Fees | | $ | 0 | | | $ | 0 | | | $ | 0 | | $ | 0 | |

| All Other Fees | | $ | 0 | | | $ | 0 | | | $ | 0 | | $ | 0 | |

For FY 20082009 and FY 2009,2010, “Audit Fees” consist of fees for professional services associated with the annual consolidated financial statements audit, review of the interim consolidated financial statements included in the Company’s quarterly reports on Form 10-Q, and regulatory filings. Audit fees for both years also include fees for professional services rendered for the audits of management’s assessment of the effectiveness of internal controls over financial reporting and Sarbanes-Oxley compliance. “Audit-Related Fees” consist of fees for services relatedThe Audit Committee reviews each non audit service to be provided and assesses the performanceimpact of the audit and review ofservice on the Company’s financial statements; thereindependent registered public accountant’s independence. There were no Audit-Related Fees for FY 20082009 or FY 2009.2010.

PROPOSAL THREE: APPROVAL OF AMENDMENT TO THE COMPANY’S 2006 LONG-TERM

INCENTIVE PLAN

ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION

General

The recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and related rules of the SEC enables stockholders to approve an advisory resolution on our executive compensation, as disclosed in this Proxy Statement. We describe this item as an advisory vote on executive compensation, but it is more commonly known as “say-on-pay.”

In considering their vote, we urge our shareholders to review carefully our compensation policies and decisions regarding our named executive officers as presented in the “Compensation Discussion and Analysis” section beginning on page 18 of this Proxy Statement. As described in that section, we believe that our compensation programs have been appropriately designed to meet their objectives and that the compensation of our named executive officers reported in this Proxy Statement has contributed to our growth, our ability to manage our business during the recent economic slowdown and to our future prospects.

The

Because the vote on this proposal is advisory in nature, it will not affect any compensation already paid or awarded to any named executive officer and will not be binding on or overrule any decisions by our Board has approved an amendmentof Directors. Although non-binding, our Board of Directors and the Compensation Committee will review and consider the voting results when making future decisions regarding our executive compensation program.

Accordingly, we are asking our shareholders to approve, in a non-binding vote, the following resolution in respect of this Proposal 3:

“RESOLVED, that the stockholders of the Corporation hereby approve the compensation paid to the 2006 Long-Term Incentive Plan (the “2006 Plan”), subjectCompany’s named executive officers as disclosed in the proxy statement for our 2011 Annual Meeting of Shareholders pursuant to stockholder approval, to (a) increaseItem 402 of Regulation S-K, including the maximum aggregate number of shares authorized for issuance under the 2006 Plan from 750,000 shares to 1,500,000 shares (in each case prior to taking into account provisions under the 2006 Plan allowing shares that were available under the Company’s predecessor stock incentive plan as of its termination date (and shares subject to options granted under the predecessor plan that expire or terminate without having been fully exercised) to be available again for issuance under the 2006 Plan)Compensation Discussion and (b) permit stock appreciation rights, settled in shares, to be issued under the 2006 Plan.

Analysis, compensation tables and narrative discussion.”

On March 16, 2010, the Board approved the amendment to increase the number of shares authorized for issuance under the 2006 Plan by 750,000 to ensure that the Company can continue to grant stock-based awards to directors and employees of and consultants to the Company at levels determined appropriate by the Board and a committee or committees appointed by the Board to administer the 2006 Plan. As of March 25, 2010, 59,564 shares remained available for grant under the 2006 Plan. On March 16, 2010 the Board also approved an amendment to the 2006 Plan to permit the issuance of stock appreciation rights, or SARs, under the 2006 Plan.

The use of stock options has long been a vital component of the Company’s overall compensation philosophy, which is premised on the principle that any long-term pay-for-performance incentive compensation should be closely aligned with stockholders’ interests. Over the years, the Company believes that it has been very successful in achieving this objective through the use of fixed-price stock options for its employees. Fixed-price stock options align employees’ interests directly with those of other stockholders because an increase in stock price after the date of award is necessary for employees to realize any value, thus rewarding employees only upon improved stock price performance.Vote Required

The Company believes that stock options, restricted stock awards and SARs are necessary to enable the Company to attract and retain the talent critical for an innovative enterprise focused on sustainable growth. The amendment to permit the issuance of SARs offers the Company another type of award to provide incentive compensation to our executive officers and employees that is based upon the performance of the Company’s stock price, and to motivate employees with compensation conditioned upon achievement of our financial goals.

Description of the 2006 Plan

The following summary of the material features of the 2006 Plan, as proposed to be amended, is qualified in its entirety by reference to the full text of the 2006 Plan, a copy of which is attached as Appendix A to the Proxy Statement. Unless otherwise specified, capitalized terms used herein have the meanings assigned to them in the 2006 Plan.

The 2006 Plan authorizes the grant of stock options (including incentive stock options and nonqualified stock options) and restricted stock awards, or any combination thereof, to persons who are at the time of the grant of an award employees, officers, directors (and, subject to restrictions applicable to incentive stock options and restrictions under Section 409A of the Code, persons who may become employees, officers or directors), and consultants of the Company or of any Subsidiary of the Company, as may be selected by the Administrator as defined below. Only employees of the Company or of any Subsidiary of the Company are eligible to receive grants of incentive stock options. As of March 25, 2010, the number of employees, officers and directors of the Company eligible to receive grants under the 2006 Plan was approximately 123 persons. The number of consultants or contractors eligible to receive grants under the 2006 Plan varies depending on the number then engaged by the Company, and was 20 persons as of March 25, 2010.

Administration

The 2006 Plan is administered by the Compensation Committee of the Board, and is referred to as the “Administrator.” The Administrator has all the powers vested in it by the terms of the 2006 Plan, including the authority to determine eligibility, to grant awards, to prescribe Award Agreements evidencing such awards, to determine whether a stock option shall be an incentive stock option or a nonqualified stock option, to determine any exceptions to nontransferability, to establish any performance goals or criteria or other conditions applicable to awards and the satisfaction thereof, to determine the period during which awards may be exercised, to determine the period during which awards shall be subject to restrictions, and to otherwise administer t he 2006 Plan.

Shares Available for the 2006 Plan

Under the 2006 Plan as proposed to be amended, the maximum number of shares of common stock that may be granted as awards will be increased from 750,000 shares to 1,500,000 shares of Common Stock (the “Shares”), plus the number of Shares that were available under the Company’s predecessor stock incentive plan as of its termination date (and Shares subject to options granted under the predecessor plan that expire or terminate without having been fully exercised). The maximum number of Shares issuable pursuant to incentive stock options granted under the 2006 Plan is 750,000. If the proposed amendment increasing the number of shares is approved, the Company will consider increasing the maximum aggregate number of share s authorized for issuance pursuant to the exercise of incentive stock options, if such increase is necessary.

If an award expires or terminates unexercised or is forfeited, or if any Shares are surrendered to the Company in connection with an award, the Shares subject to such award and the surrendered Shares will become available for further awards under the Plan. The number of Shares subject to the Plan (as well as the number of Shares and terms of any award, the number of Shares issuable as incentive stock options, and the individual award maximum described below) may be adjusted by the Administrator in the event of any change in the outstanding Common Stock by reason of any reorganization, recapitalization, stock dividend, stock split, combination or any other change in the shares of Common Stock.

A maximum of 100,000 Shares subject to awards may be granted to an individual during any calendar year to under the Plan.

Stock Options

The 2006 Plan authorizes the grant of incentive stock options and nonqualified stock options. Incentive stock options are stock options that satisfy the requirements of Section 422 of the Internal Revenue Code (the “Code”). Nonqualified stock options are stock options that do not satisfy the requirements of Section 422 of the Code. Options granted under the 2006 Plan would entitle the grantee, upon exercise, to purchase a specified number of Shares from the Company at a specified exercise price per Share. Stock options must have an exercise price at least equal to fair market value (as determined under the 2006 Plan, the “Fair Market Value”) on the date of grant , or at least 110% of Fair Market Value in the case of incentive stock options granted to a 10% Shareholder.

Restricted Stock Awards

The 2006 Plan authorizes the grant of restricted stock awards. Restricted stock is an award or issuance of Shares the grant, issuance, retention, vesting and/or transferability of which is subject during specified periods of time to such conditions (including continued employment or performance conditions) and terms as determined by the Administrator. Such terms and conditions may provide, in the discretion of the Administrator, for the lapse of issuance, vesting or transfer restrictions or retention provisions to be contingent upon the achievement of one or more specified Performance Goals.

“Performance Goals” means performance goals established by the Administrator which may be based on one or more business criteria selected by the Administrator that apply to an individual or group of individuals, a business unit, or the Company and/or one or more of its Subsidiaries either separately or together, over such performance period as the Administrator may designate, including, but not limited to, business criteria based on operating income, earnings or earnings growth, sales, return on assets, equity or investment, satisfactory internal or external audits, improvement of financial ratings, achievement of balance sheet or income statement objectives, or any other objective goals established by the Administrator, and may be absolute in their terms or measured against or in relationship to other companies comparably, similarly or otherwise situated.

Stock Appreciation Rights

Under the 2006 Plan (as proposed to be amended), a recipient of a SAR is generally entitled to receive, upon exercise and without payment to the Company (but subject to required tax withholdings), that number of Shares having an aggregate Fair Market Value as of the date of exercise not to exceed the number of Shares subject to the portion of the SAR exercised, multiplied by an amount equal to the excess of (i) the Fair Market Value per Share on the date of exercise of the SAR over (ii) the Fair Market Value per Share on the date of grant of the SAR (or such amount in excess of the Fair Market Value per Share as the Administrator may specify). The terms and conditions applicable to a SAR (including upon termination or change in the status of employment or service of the recipient with th e Company and its subsidiaries) shall be determined by the Administrator and set forth in the Award Agreement applicable to the SAR. Each SAR shall expire within a period of not more than ten (10) years from the date of grant.

Transferability

Except as otherwise determined by the Administrator or provided in a Award Agreement, awards granted under the 2006 Plan are not transferable except by will or the laws of descent and distribution. Unless otherwise determined by the Administrator, awards may be exercised only by the grantee during his or her lifetime.

Amendment and Termination

Subject to the terms and restrictions set forth in the Plan, the Board of Directors may amend, alter or discontinue the 2006 Plan, or any portion thereof, at any time; provided that the Board of Directors will not modify or amend the Plan without stockholder approval to the extent required by the Code or the rules of Nasdaq or the SEC.. No award may be granted under the 2006 Plan after the close of business on March 31, 2016. Subject to other applicable provisions of the 2006 Plan, all awards made under the 2006 Plan prior to the termination of the 2006 Plan will remain in effect until those awards have been satisfied or terminated.

Summary of Certain Federal Income Tax Consequences

General

The following discussion briefly summarizes certain federal income tax aspects of stock options, SARs and restricted stock awards granted under the 2006 Plan. The rules governing the tax treatment of awards and the receipt of Shares are quite technical, so the following description of tax consequences is necessarily general in nature and does not purport to be complete. Moreover, statutory provisions are subject to change, as are their interpretations, and their application may vary in individual circumstances. Finally, the tax consequences under applicable state and local law may not be the same as under the federal income tax laws.

Incentive Stock Options

In general, a grantee will not recognize income on the grant or exercise of an incentive stock option. However, the difference between the exercise price and the fair market value of the stock on the exercise date is an adjustment item for purposes of the alternative minimum tax. Further, if a grantee does not exercise an incentive stock option within certain specified periods after termination of employment, the grantee will recognize ordinary income on the exercise of an incentive stock option in the same manner as on the exercise of a nonqualified stock option, as described below.

Nonqualified Stock Options and Stock Appreciation Rights

A grantee generally is not required to recognize income on the grant of a nonqualified stock option or a SAR. Generally, ordinary income is required to be recognized on the date the nonqualified stock option or SAR is exercised. In general, the amount of ordinary income required to be recognized is (a) in the case of a nonqualified stock option, an amount equal to the excess, if any, of the fair market value of the Shares on the exercise date over the exercise price, and (b) in the case of a stock appreciation right settled in shares, the amount of the fair market value of any shares received upon exercise (plus the amount of taxes withheld from such amount).

Restricted Stock

Unless a grantee of restricted stock makes an election under Section 83(b) of the Code as described below, the grantee generally is not required to recognize ordinary income on the award of restricted stock. Instead, on the date that the Shares vest (i.e., become transferable or no longer subject to a substantial risk of forfeiture), the grantee will be required to recognize ordinary income in an amount equal to the excess, if any, of the Fair Market Value of the Shares on such date over the amount, if any, paid for such Shares. If a grantee makes a Section 83(b) election to recognize ordinary income on the date the Shares are awarded, the amount of ordinary income required to be recognized at the time of grant is an amount equal to the excess, if any, of the Fair Market Value of the Shares on the date of grant over the amount, if any, paid for such Shares. In such case, the grantee will not be required to recognize additional ordinary income when the Shares vest.

Gain or Loss on Sale or Exchange of 2006 Plan Shares

In general, gain or loss from the sale or exchange of Shares granted or awarded under the 2006 Plan will be treated as capital gain or loss, if the Shares are held as capital assets at the time of the sale or exchange. However, if certain holding period requirements are not satisfied at the time of a sale or exchange of Shares acquired upon exercise of an incentive stock option (a “disqualifying disposition”), a grantee generally will be required to recognize ordinary income upon such disposition.

Deductibility by Company

The Company generally is not allowed a deduction in connection with the grant or exercise of an incentive stock option. However, if a grantee is required to recognize income as a result of a disqualifying disposition, the Company generally will be entitled to a deduction equal to the amount of ordinary income so recognized. In general, in the case of a nonqualified stock option (including an incentive stock option that is treated as a nonqualified stock option, as described above), a SAR or a restricted stock award, the Company generally will be allowed a deduction in an amount equal to the amount of ordinary income recognized by the grantee, provided that certain income tax reporting requirements are satisfied.

Parachute Payments

�� Where payments to certain persons that are contingent on a change in control exceed limits specified in the Code, the person generally is liable for a 20% excise tax on, and the corporation or other entity making the payment generally is not entitled to any deduction for, a specified portion of such payments. If the Administrator, in its discretion, grants awards, the exercise date, vesting or payment of which is accelerated by a change in control of the Company, such acceleration of the exercise date, vesting or payment would be relevant in determining whether the excise tax and deduction disallowance rules would be triggered.

Tax Rules Affecting Nonqualified Deferred Compensation Plans.

Section 409A of the Code imposes tax rules that apply to “nonqualified deferred compensation plans.” Failure to comply with, or qualify for an exemption from, the rules with respect to an award could result in significant adverse tax results to the grantee of such Award, including immediate taxation upon vesting and an additional income tax of 20 percent of the amount of income so recognized. The 2006 Plan is intended to allow the granting of awards which are intended to comply with, or qualify for an exemption from, Section 409A of the Code.

Performance-Based Compensation

Subject to certain exceptions, Section 162(m) of the Code disallows federal income tax deductions for compensation paid by a publicly-held corporation to certain executives to the extent the amount paid to the executive exceeds $1 million for the taxable year. The 2006 Plan has been designed to allow the Administrator to make awards under the 2006 Plan that qualify under an exception to the deduction limit of Section 162(m) for “performance-based compensation.”

Vote Required For Approval

The affirmative vote of a majority of the total votes cast by the stockholdersall shares of common stock present at the meeting, in person or by proxy,represented and entitled to vote on this proposalat the Annual Meeting is necessaryrequired for advisory approval of the amendment to the 2006 Plan. If you submit a proxy without direction as to a vote on this matter, the proxyproposal. This will be voted “FOR” the proposal. Abstentionsconsidered a non-routine item. As a non-routine item, there may be broker non-votes. Broker non-votes and abstentions will have no effect on the effectoutcome of a vote against thisthe proposal. Broker non-votes (shares held by brokers that do not have discretionary authority to vote on a matter and have not received voting instructions from their clients) will be treated as not entitled to vote and have no effect.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOUA VOTE “FOR” THE“FOR” APPROVAL OF THE AMENDMENT TO THE COMPANY’S 2006 LONG-TERM INCENTIVE PLAN.

Equity Compensation Plan Information

The following table provides information as of December 31, 2009 about the securities authorized for issuance to our employees and non-employee directors under our stock-based compensation plans:

| Plan Category | | Column A | | | Column B | | | Column C | |

| | | Number of securities to be issued upon exercise of outstanding options, warrants and rights (#) | | | Weighted-average exercise price of outstanding options, warrants and rights ($) | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in Column A (#) | |

| Equity compensation plans approved by security holders | | | 1,838,096 | | | $ | 5.86 | | | | 59,564 | |

| Equity compensation plans not approved by security holders | | | -- | | | | -- | | | | -- | |

| Total | | | 1,838,096 | | | $ | 5.86 | | | | 59,564 | |

ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION.

***

PROPOSAL FOUR: ADVISORY VOTE ON FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION

In accordance with the Dodd-Frank Act and the related rules of the SEC, we are requesting our shareholders recommend, in a non-binding vote, whether we should ask our shareholders to approve the compensation of our named executive officers in a non-binding vote (that is, a vote similar to the vote in Proposal 3 above) every one, two or three years.

After careful consideration of the frequency alternatives, we believe that conducting an advisory vote on executive compensation every three years is appropriate for us and our shareholders at this time. Our executive compensation program is designed such that executives are not encouraged to take risks for short-term gain at the expense of the long-term health of our business. As a public company, elements of our executive compensation program are designed to align employee interests with those of our shareholders, which is why we implemented our long-term incentive compensation programs. Conducting an advisory vote on executive compensation every year or every two years does not give our shareholders sufficient time to evaluate the effectiveness of our long-term compensation programs. We believe that a three-year cycle will provide our shareholders sufficient time to evaluate the effectiveness of both our short- and long-term compensation programs. In addition, we believe that a three-year cycle will give our Board of Directors and our Compensation Committee sufficient time to consider the results of the annual advisory vote on executive compensation, determine if any changes need to be made to our compensation programs and evaluate the effectiveness of the structure of our short- and long-term compensation programs.

Accordingly, we are asking our shareholders to vote to conduct an advisory vote on executive compensation every three years. Our Board of Directors will carefully consider the outcome of this vote when making future decisions regarding the frequency of advisory votes on executive compensation. However, because this vote is advisory and not binding, our Board of Directors may decide that it is in the best interests of us and our shareholders to hold an advisory vote on executive compensation more or less frequently than the alternative that has been selected by our stockholders.

The affirmative vote of a majority of all shares of common stock present or represented and entitled to vote at the Annual Meeting is required for advisory approval of this proposal. This will be considered a non-routine item. As a non-routine item, there may be broker non-votes. Abstentions and broker non-votes will have no effect on the outcome of the proposal.

Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR “EVERY THREE YEARS” TO CONDUCT AN ADVISORY VOTE ON EXECUTIVE COMPENSATION.

CORPORATE GOVERNANCE

Role of the Board

It is the duty of the Board to oversee the Company's Chief Executive Officer (the “CEO”) and other senior management in the competent and ethical operation of the Company on a day-to-day basis and to assure that the long-term interests of the shareholders are being served. To satisfy this duty, the directors take a proactive, focused approach to their position, and set standards to ensure that the Company is committed to business success through maintenance of high standards of responsibility and ethics. In FY 2009,2010, the full Board held fiveeight meetings inclusive of the annual meeting of shareholders.

Director Independence

The Board has determined that all Board members, excluding Mssrs. Nicolaides and Ryan, are independent under applicable NASDAQ and SEC rules. Furthermore, the Board has determined that each member of each of the committees of the Board of Directors is independent within the meaning of NASDAQ’s and the SEC’s director independence standards. In making this determination, the Board solicited information from each of the Company’s directors regarding several factors, including whether such director, or any member of his immediate family, had a direct or indirect material interest in any transactions involving the Company, was involved in a debt relationship with the Company or received personal benefits outside the scope of such person’s normal compensation. The Board considered the responses of the Company’s directors, and independently considered all other material information relevant to each such director in determining such director’s independence under applicable SEC and NASDAQ rules.

Board Leadership Structure

The Board does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board, as the Board believes it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. The Board believes the combined role of Chairman and Chief Executive Officer, together with an independent lead director, is in the best interest of stockholders at this time because it provides the appropriate balance between strategy development and independent oversight of management. In addition, much of the work of the Board is conducted through its committees. Our Board has three standing committees—Audit, Compensation, and Corpor ateCorporate Governance and Nominating, as further described below. Each of the Board committees is comprised solely of independent directors, with each of the three committees having a separate chair. One of the key responsibilities of the Board is to develop the strategic direction for the Company, and provide management oversight for the execution of that strategy.

Board Role in Risk Oversight

The responsibility for the day-to-day management of risk lies with management, while the Board, and each of the Board committees, is responsible for overseeing the risk management process to ensure that it is properly designed, well-functioning and consistent with the Company’s overall corporate strategy. The role of the Board of Directors in the Company’s risk oversight process includes reviewing the Company’s key business risks, understanding how these risks could affect our Company and receiving regular reports from members of senior management on areas of material risk to the Company, including operational, financial, legal, investment and liquidity, and strategic and reputational risks. The Board also believes its oversight of risk is enhanced by its current leadership structure (discussed above) because the Chief Executive Officer, who is ultimately responsible for the Company's management of risk, also chairs regular Board meetings, and with his in-depth knowledge and understanding of the Company, is best able to bring key business issues and risks to the Board's attention.

Compensation Risk

Our Compensation Committee has considered the various elements of Numerex’s compensation program and does not believe it encourage excessive or inappropriate risk taking.

We structure our pay to consist of both fixed and variable compensation. The fixed (or salary) portion of compensation is designed to provide a steady income regardless of our stock price performance or short-term business performance so that executives and managers have a threshold level of financial security and are not pressured to produce short-term gains at the expense of long-term business results or through means at odds with our corporate values.

The variable (the short-term performance award or bonuses and equity) portions of compensation are designed to reward both short- and long-term corporate performance in a balanced manner. Our short-term performance awards for all Named Executive Officers and most other executives are based on the balanced achievement of annual EBITDA and revenue goals (EBITDA refers to earnings before interest, taxes, depreciation, amortization and non-recurring items). Further, short-term incentive awards are capped at two times targeted payouts and are only paid in the event of exceptional business results.

For long-term performance, our stock option awards generally vest over four years and provide value only if our stock price increases over time. This is a further encouragement to our executives to consider their actions in the context of the long-term health of our business.

We feel that that our balanced mix of cash and equity compensation, revenue and profitability, fixed and variable pay and capped bonus payouts provide sufficient incentives to keep executives focused on those activities that produce long-term shareholder growth while not creating incentives for them take unnecessary or excessive risks.

Board Committees

The Board has a standing Audit and Finance Committee (the “Audit Committee”), Compensation Committee (the “Compensation Committee”), and Nominating and Corporate Governance Committee (the “Nominating Committee”). The Board has determined that all committee chairs and committee members are independent under the applicable NASDAQ and SEC rules. The members of each of the Company’s committees are identified in the table below.

Name | | Audit Committee | | | Compensation Committee | | | Nominating Committee | |

| Brian C. Beazer | | | * | | | | * | | | Chairman | |

| George Benson | | | * | | | Chairman | | | | * | |

| E. James Constantine | | | * | | | | | | | | * | |

| Stratton J. Nicolaides | | | | | | | | | | | | |

| John G. Raos | | Chairman | | | | * | | | | | |

| Andrew J. Ryan | | | | | | | | | | | | |

Audit Committee

The Audit Committee met eightnine times in FY 2009.2010. The Board of Directors has determined that John Raos, Chairman of the Audit Committee, is an “audit committee financial expert” as defined by the SEC. The principal functions of the Audit Committee are to: (a) assist in the oversight of the integrity of the Company’s financial statements, the Company’s compliance with legal and regulatory requirements, the qualifications and independence of the Company’s independent auditors and the performance of the Company’s independent auditors; (b) approve the selection, appointment, retention and/or termination of the Company’s independent auditors, as well as approving the compensation thereof; and (c) approve all audit and permissible non-audit services provided to the Company and certain ot herother persons by such independent auditors. The Audit Committee Charter is available on the Company’s website at http://www.numerex.com/Company/Corporate-Governance2.aspx.

Compensation Committee

The Compensation Committee met fivenine times in FY 2009.2010. The Compensation Committee is responsible primarily for reviewing the compensation arrangements for the Company's executive officers, including the Chief Executive Officer, and for formulating the Company's equity compensation plans. Additional information on the Compensation Committee’s processes and procedures for the consideration of executive compensation are addressed in the Compensation Discussion and Analysis below. The Compensation Committee Charter is available on the Company’s website at http://www.numerex.com/Company/Corporate-Governance2.aspx. All of the members of the Compensation Committee have been determined by the Board to be independent under applicable NASDAQ and SEC rules.

Nominating and Corporate Governance Committee

The Nominating Committee met two times during FY 2009.2010. The Nominating Committee assists the Board in identifying qualified individuals to become directors, determines the composition of the Board and its committees, monitors the process to assess the Board's effectiveness and helps develop and implement the Company's Corporate Governance Guidelines. The Nominating Committee reviews the performance of the Board, its Committees, together with their members. The Nominating Committee also considers nominees for election as directors proposed by shareholders. The Nominating Committee Charter specifies that the composition of the Board should reflect experience in the following areas: finance, compensation, sales and marketing, technology and production. The Nominating Committee Charter is available on the Company’s website at http://www.numerex.com/Company/Corporate-Governance2.aspx.

Attendance at Meetings

Each director attended at least 95%96% of the meetings of the Board of Directors and its committees of which he was a member. Directors are encouraged, but not required, to attend the Company’s annual meetings of shareholders. Although no director is required to do so, fiveall six of the Company’s directors attended the annual meeting of shareholders on May 15, 2009.21, 2010. Non-management members of the Board meet in executive sessions, absent the Company’s employee director, following regularly scheduled in-person meetings of the Board.

Executive Sessions

Executive sessions of the independent directors are held at least one timeonce each year following regularly scheduled in-person meetings of the Board of Directors. These executive sessions include only those directors who meet the independence requirements promulgated by NASDAQ, and Mr. Raos, as the Lead Director and Vice-Chairman of the Board, is responsible for chairing these executive sessions. The Board’s independent directors attended two executive sessions in FY 2009.2010.

Code of Ethics

The Company has a Code of Ethics and Business Conduct (the “Code”) that applies to the Company’s directors, officers, and employees, including the Company’s Chief Executive Officer and Chief Financial Officer. The Code is available on the Company’s website at http://www.numerex.com/Company/Corporate-Governance2.aspx. We will disclose any future amendments to, or waivers from, provisions of these ethics policies and standards on our website as promptly as practicable, as may be required under applicable SEC and Nasdaq rules.

Right to Designate Director

The Company has entered into an agreement providing Gwynedd Resources Ltd. (“Gwynedd”) the right to designate one director to the Board of Directors. Additionally, if the Board consists of more than seven directors, Gwynedd, at its option, may designate one additional director. Any designee’s appointment will be subject to the exercise by the Board of Directors of its fiduciary duties and the approval of the Company’s shareholders upon the expiration of any appointed term at the next annual meeting of shareholders. Gwynedd’s right to designate a director will cease at such time as Gwynedd’s equity interest in the Company drops below 10% of the outstanding shares of Common Stock. Mr. Ryan currently serves as Gwynedd’s sole designee on the Board.

Communications with the Board of Directors

Any shareholder who wishes to send any communications to the Board or a specific director should deliver such communications to the General Counsel and Secretary of the Company at 1600 Parkwood Circle SE, Suite 500, Atlanta, Georgia 30339, who will forward appropriate communications to the Board. Inappropriate communications include correspondence that is unrelated to the operation of the Company or the Board, is inappropriate for Board consideration, such as advertisements or other commercial communications, or is threatening or otherwise offensive. The Company’s General Counsel and Secretary may consult with other officers of the Company, counsel, and other advisers as appropriate, in making this determination.

Consideration of Director Nominees

The Nominating Committee will consider nominees for director recommended by a shareholder submitted in accordance with the procedure set forth in the Company’s Bylaws. In general, the procedure set forth in the Company’s Bylaws provides that a notice relating to the nomination must be timely given in writing to the: Secretary of the Company, Numerex Corp., 1600 Parkwood Circle SE, Atlanta, Georgia 30339. To be timely, the notice must have been delivered by the 90th 90th day prior to the anniversary of the prior year’s annual meeting. Such notice must include all information relating to such person that is required to be disclosed in solicitations of proxies for the election of directors, including information relating to the business experience and background of the potential nominee, and certain information with respect to the nominating shareholder and any persons acting in concert with the nominating shareholder. Any such recommendation must also be accompanied by a written consent of the individual to stand for election if nominated by the Board of Directors and to serve if elected by the shareholders. The Nominating Committee Charter is available on the Company’s website at http://www.numerex.com/Company/Corporate-Governance2.aspx.

The Nominating Committee generally identifies potential nominees through its network of contacts, and may also engage, if it deems appropriate, a professional search firm. The Nominating Committee meets to discuss and consider such candidates’ qualifications and then chooses director candidates by majority vote. There are no differences in the manner in which the Nominating Committee evaluates potential nominees for director based on whether such potential nominees are recommended by a shareholder or by any other source. The Nominating Committee does not have specific, minimum qualifications for nominees and has not established specific qualities or skills that it regards as absolutely necessary for one or more of the Company’s directors to possess (other than any qualities or skills that may be required by applicable law, regulation or listing standard). The Nominating Committee’s Charter identifies diversity as a consideration with regard to the identification of director nominees, and the Nominating Committee strives to nominate directors with a variety of complementary skills such that, as a group, the Board will possess an appropriate diversity of professional experience, education, knowledge, skills, and abilities to oversee the Company's businesses. Further to the foregoing, in evaluating a person as a potential nominee to serve as a Director of the Company, the Committee considers the following factors, among any others it may deem relevant:

whether or not the person has any relationships that might impair his or her independence, such as any business, financial or family relationships with Company management, Company service providers or their affiliates;

| • | whether or not the person has any relationships that might impair his or her independence, such as any business, financial or family relationships with Company management, Company service providers or their affiliates; |

| | |

whether or not the person serves on boards of, or is otherwise affiliated with, competing organizations;

| • | whether or not the person serves on boards of, or is otherwise affiliated with, competing organizations; |

| | |